Introduction to Price range vs Precise Dashboards

What’s a Price range vs Precise Dashboard?

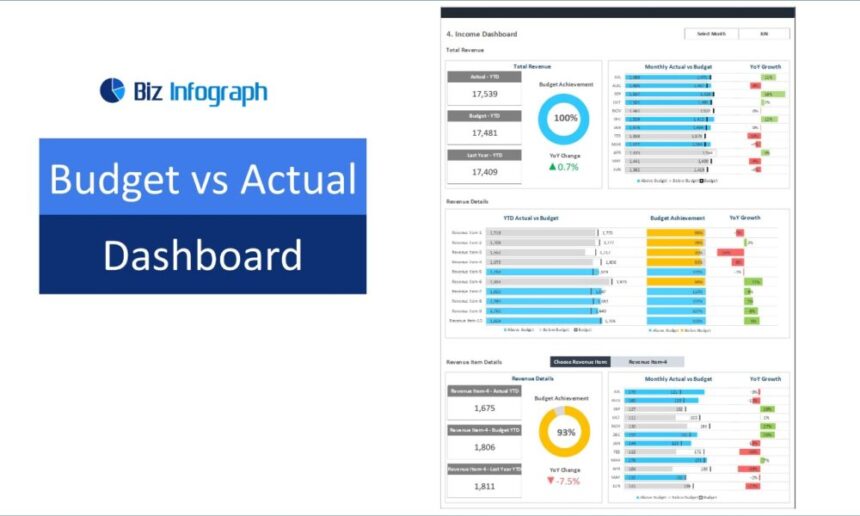

A finances vs. precise is a software, within the type of a chart or graph, that compares the deliberate finances allocation for an initiative or venture towards the historic spending on the venture. Thus, finances vs. precise dashboards will assist simply observe whether or not initiatives stay throughout the finances and whether or not they may exceed prices to finish the venture. Price range dashboards will also be part of the venture evaluation; realizing which initiatives have been over finances and why may help when setting the finances for the following venture. Price range vs Precise Dashboard: Monitor, analyse, and handle monetary efficiency with precision.

The Significance of Monetary Accuracy in Enterprise

Suppose a monetary data has been gathered and disclosed appropriately and uniformly inside a sure interval. In that case, such a message signifies that the enterprise efficiency inside this period will be ascertained to permit leaders to investigate features such because the change in taxes or hike in uncooked supplies costs. This, in flip, can movement into technique formulation.

Key Options of a Price range vs Precise Dashboard

Actual-Time Monitoring of Monetary Efficiency

A budget-to-actual assertion compares precise spending with the deliberate finances in real-time. The weather embrace real-time graphs and charts that show deviations, bills and revenues evaluation, and notifications on giant deviations. This makes it simple to take away or add particular methods to attain the perfect goals or monetary targets on course.

Visualization Instruments and Their Advantages

Charts, graphs, and heatmaps are visualization instruments that assist us perceive complicated information. They draw tendencies, present patterns, make comparisons extra accessible, and enhance our means to grasp and make choices. These instruments are useful for functions in that they make it simpler to achieve data, spot points, talk findings to these above us, and strategize.

Customizable Alerts for Price range Deviations

Versatile variations of finances stories inform customers of great disparities from deliberate finances values. Such alerts could also be set by quantifiable measures, comparable to when a selected finances has been surpassed or maybe attributable to some uncommon expenditure exercise. Particularly, well timed notification lets us tackle the recognized issues in time, make the wanted modifications, and achieve some monetary management to satisfy the budgets effectively.

Advantages of Utilizing a Price range vs Precise Dashboard

Enhanced Choice-Making Capabilities

A Price range vs. Precise dashboard aids in arriving at sound choices, particularly when evaluating the budgeted figures and the precise monetary outcomes. It helps within the well timed detection of deviations, factors out the areas requiring focus, and aids in making modifications primarily based on numerical values. The actual-time data assists the managers in making acceptable choices. Subsequently, useful resource utilization is managed, and basic enterprise efficiency is enhanced.

Improved Monetary Planning and Evaluation

Flexibility is attained by way of the implementation of a Price range vs. Precise dashboard that presents the monetary finances and efficiency tendencies. Thus, it would grant a sure stage of consciousness, which in flip gives the chance for extra exact estimations of the required assets and their reallocation, thus leading to efficient monetary exercise and improved long-term planning.

Figuring out Tendencies and Potential Financial savings

A Price range vs. Precise dashboard assists with tendencies and attainable financial savings by evaluating precise and finances values. Reviewing such elements exposes quite a few irregularities that outline extreme expenditure, making it simpler to establish potential areas of cuts and correct useful resource appropriation to reinforce effectiveness in managing assets, therefore slicing prices.

Implementing a Price range vs Precise Dashboard

Preliminary Setup and Information Integration

It’s important to know that whereas adopting a Price range vs. Precise dashboard, particular key efficiency indicators ought to be established with the associated finance information feeds. The enter information ought to be collected accurately from accounting techniques or spreadsheets, and the dashboard ought to be adjusted to incorporate important budgeting forecasts and precise prices. Information should be up to date often. Subsequently, correct schedules for refreshing the information ought to be estimated to have up to date and extra correct outcomes when the evaluation is performed.

Coaching Employees and Selling Adoption

The stakeholders ought to clarify to the employees how one can use the Price range vs. Precise dashboard utilizing sensible demonstrations and tutorials. They need to stress its significance and relevance to monetary evaluation and attainable monetary choices. This may be executed by way of one-ring efficiency enchancment that illuminates the advantages of adoption by way of effectivity and accuracy. Make sure that assist is obtainable sooner or later and suggestions supplied to ensure that the instruments are successfully built-in into the monetary administration practices being adopted within the establishment.

Finest Practices for Sustaining Dashboard Accuracy

Hold the dashboard information present in order that the supply information underlying the dashboard is clear and proficient. A number of the greatest practices that may be beneficial embrace updating information in an automatic method to allow customers to work with real-time data. It’s good apply to examine and modify the dashboard metrics and filter settings often. Additional, employees coaching is required to cut back the possibilities of customers making errors and set up a process for coping with inconsistent information.

Overcoming Challenges with Price range vs Precise Dashboards

Addressing Widespread Information Inconsistencies

One other advice to keep away from difficulties in utilizing Price range vs. Precise dashboards is to make sure environment friendly integration and information high quality in Budgeting/Precise information gathering and incorporation from all sources. Introduce validation factors to examine for these inconsistencies and apply the correction if wanted. Make information synchronizations to check the 2 techniques often and modify the dashboard parameters given the current modifications within the accounting guidelines or enterprise procedures. This ensures that solely credible information that could possibly be of great use is collected and processed over a while.

Guaranteeing person engagement and information literacy

It ensures an energetic curiosity from the customers and fluency in information with the coaching of the core talents of the dashboard and information evaluation. Clarify how the product might be used commonly with the assistance of examples primarily based on on a regular basis utilization and related conditions. Encourage using analytics by selling a tradition that makes use of its insights for choices and helping to reinforce the customers’ information when utilizing the dashboard.

Know-how Concerns and Options

If a company is to make use of a Price range vs. Precise dashboard, it ought to search for expertise add-ons that present integration capabilities, reside standing, and capability to develop. Choose techniques that allow simple utilization and good graphical representations. Integration with present techniques is critical; safety can be important, significantly concerning cash data. Typically, enterprise wants require flexibility and the chance to regulate the infrastructure rapidly; in different circumstances, the main focus is on extra management over the surroundings; subsequently, examine cloud and on-premises options relying in your firm’s necessities.

The Way forward for Monetary Dashboard

Evolving Applied sciences in Price range Monitoring

The emergence of such applied sciences as AI and machine studying will additional outline the event of monetary dashboards by way of predictive and automatic insights. Information acquisition and utilization in real-time and incorporating cloud expertise might be extra versatile and expandable options. With improved methods in visualization and efficient Biz Infograph enterprise dashboards will grow to be extra logical, offering extra profound monetary evaluation outcomes and improved strategic decision-making.

Predictive Analytics and Forecasting

Enterprise intelligence optimization improves the efficiency of monetary dashboards by using information and statistical fashions to estimate future tendencies. This enables the formulation of methods that assist enterprise organizations forecast their doubtless monetary efficiency and the dangers concerned and take early corrective measures if essential. With the assistance of those methods, dashboards can provide higher forecasting and clever details about enterprise executives, which is able to assist in strategic administration and higher useful resource utilization.

The Rising Significance of Monetary Dashboards in Strategic Planning

Price range, monetary, and different analytic fast reference instruments or customizable monetary ‘tickers’ have gotten crucial in strategic planning as they supply instantaneous present standing of a enterprise’s efficiency and financial situations. Thus, they assist to make efficient choices, to watch the achievement of organizational targets, and to make essential modifications on time. This improves the corporate’s strategic operations by giving a exact concept of how the monetary side could be deliberate and managed to suit the longer-term plans and market tendencies.

Conclusion

Price range monitoring instruments, significantly dashboards, are thus crucial in confirming compliance with monetary accuracy within the group since they ship a well timed, graphic portrayal of the distinction between the finances and the precise. These codecs draw consideration to variations and patterns, serving to put together companies for modifications and make higher choices. An ongoing apply is required to replace the information supply, enhance the metrics, and use applied sciences to keep away from discrepancies. Coaching and suggestions additionally improve the effectivity of monetary monitoring in decision-making and its correspondence with the evolving objectives of the group.